Nonetheless, some clients are dissatisfied with their advance amounts or mention difficulties having assistance from customer care or canceling their subscriptions.

Cash progress apps are a more moderen progress that likewise provides fast cash forward of your next paycheck, but usually charge A great deal decrease expenses than payday bank loan lenders or none whatsoever.

Even better, you’ll have the cash you'll need relatively swiftly. But you will find downsides, such as the borrowing prices you may count on and the risk of relying far too intensely on this supply of fast cash to take care of a more severe fiscal challenge.

Once you've a shortlist of top rated dollars-borrowing apps, in this article’s how to match them to find the best fit:

Obtain now spend later on (BNPL) programs provide you with a smaller personal loan to help make an online buy which you in any other case would not manage to afford to pay for. Shorter-time period BNPL loans typically don’t have fascination, but You'll have to repay the bank loan more than 4 or 6 installments in excess of a few months to stop late service fees.

1Chime SpotMe is surely an optional company that requires an individual deposit of $200 or more in qualifying direct deposits to your Chime Examining Account every month. All qualifying customers are going to be allowed to overdraw their account around $twenty on debit card purchases and cash withdrawals at first, but may very well be later on qualified for an increased limit of around $two hundred or maybe more based on member’s Chime Account background, direct deposit frequency and volume, expending activity as well as other possibility-centered components.

What exactly are previous and recent shoppers saying regarding the app? Do the critiques suggest General satisfaction, or is there result in for problem?

Prequalification application — You could Verify your potential price without influencing your credit score scores, which is useful if you'd like to look at estimated phrases before you officially implement.

Your eligibility and desire fees are according to your credit score historical past and credit scores, amid other variables, so it’s a smart idea to get an strategy where by your credit score is at before implementing.

This is the sort of secured financial loan, where by your vehicle is used as collateral. This means your car’s title or registration is left With all the lender right up until you fork out again the financial loan in comprehensive — and will be repossessed for those who don’t make your payments as agreed. You must repay the loan with interest and fees, usually inside 15 and 30 days.

With no an unexpected emergency fund to fall back on, challenges for instance a unsuccessful transmission or even a burst pipe could sabotage budgeting designs and bring about fiscal tension.

The Dave application’s ExtraCash™ aspect offers cash innovations of as much as $five hundred for every spend period of time. Which has a qualifying checking account, you may get an progress as a regular worker or freelancer due to the fact Dave considers your typical bank deposits and shelling out in lieu of your work hrs. You should pay back a low $1 regular monthly cost to obtain developments, but guidelines are optional.

A few other apps just offer overdraft defense. Although these don’t present conventional cash improvements, they might even now hold you in excess of right until payday. You’ll want to enroll in the application’s related bank account to qualify.

Although cash advance apps may help to include unexpected emergency fees, Additionally, there are some pitfalls to consider more info that come with employing them.

Edward Furlong Then & Now!

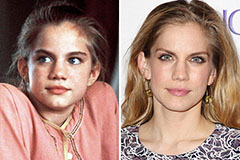

Edward Furlong Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!